Accounting & Finance FinTech and Financial Analytics

Today and Upcoming Events

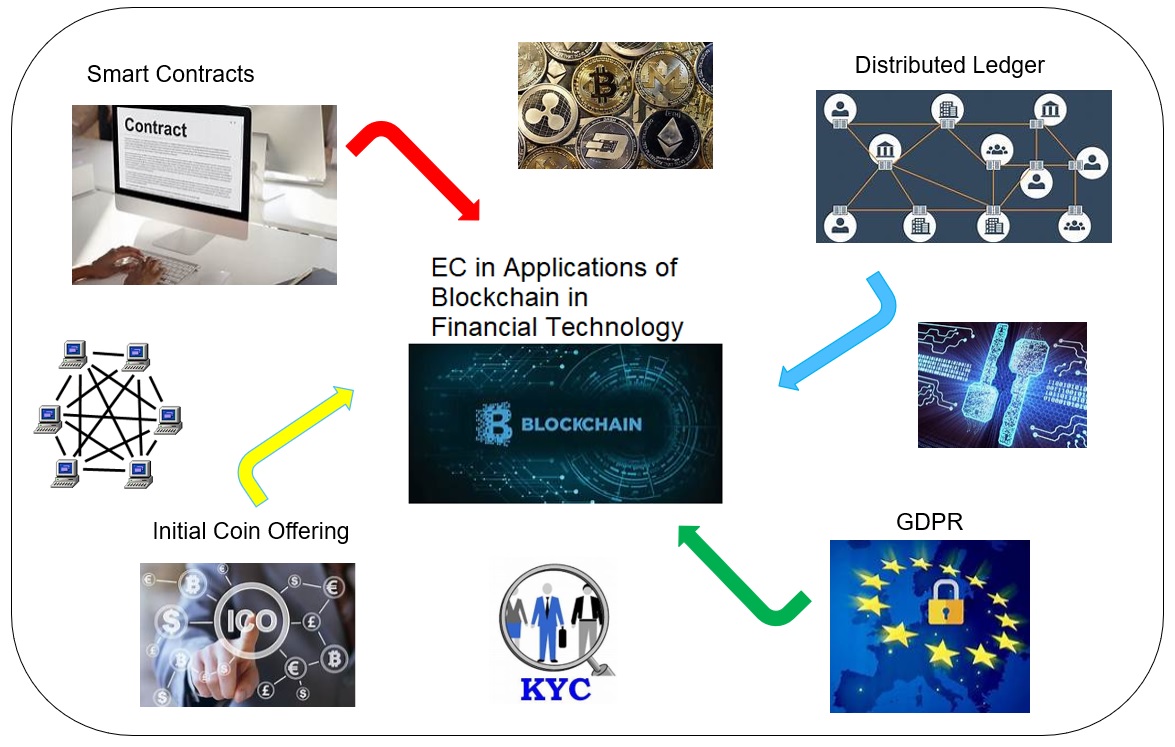

Accept New Applications for the Apr 2026 intake! The programme introduces blockchain technology and technological elements around blockchain. Our professional lecturers will share the contemporary applications around blockchain, such as Stablecoins, NFTs, CBDC, as well as the latest development of FinTech and Metaverses will be shared. Welcome to your online application!

Programme Overview

Highlights

Teacher

Mr Paul Li, President of HKFIA

Mr Li is the President of Hong Kong FinTech Industry Association which was founded in 2014 aimed to provide a platform for industry players in HK to interact with their mainland counterparts and to promote the collaboration of FinTech and traditional finance industry.

An experienced banker, Paul is now working in Alibaba group as senior fintech expert managing fintech initiatives for SMEs. Before that, he had worked in various roles in banks. In 2007, seeing the opportunity for foreign banks under the WTO agreement, Paul moved from HSBC Hong Kong to Shanghai to manage the strategy department for HSBC China. He then spent the next 6 years in various cities (Shanghai, Chongqing, Guangzhou and Shenzhen) to build corporate banking franchises for HSBC and subsequently Standard Chartered.

Paul is an advisor of Our Hong Kong Foundation, a research fellow of Zhejiang University Academy of Internet Finance, part-time lecturer of HKU SPACE and industry commentator in FinTech & RegTech.

Mr. Emil Chan, Honorary Chairman of Start HK

Emil Chan is a recognized figure with a career spanning several decades in the financial service and startup industries. He has played a key role in shaping the cross-border financial landscape, from traditional banking to cutting-edge Web3 and DeFi business strategies. In his role as a FinTech evangelist and digital transformation consultant, Emil has advised numerous corporations and SMEs on how to navigate the rapidly changing digital economy. He is a startup mentor and advisory board member of the Cyberport Startup Committee, where he helps guide and mentor the next generation of entrepreneurs.

Emil is also committed to building a nurturing environment for the FinTech ecosystem in the Greater Bay Area. He has been an adjunct professor, visiting lecturer, and guest speaker at several renowned universities for over 10 years, including CityU, HKU, PolyU, HKUST, HKBU, CUHK, LingnanU and VTC. His insights and expertise have helped to inspire and educate countless students and professionals.

Emil's contributions to the digital ecosystem go far beyond the realm of finance. In addition to being a prominent figure in the financial industry, he also holds key roles in various influential organizations. Emil serves as a respected columnist and sought-after interviewee for major media outlets. Moreover, he is the esteemed Founding Chairman of the Association of Cloud and Mobile Computing Professionals, Co-Chair of the Hong Kong Digital Finance Association, Chairman of the FinTech Committee of the Smart City Consortium, Vice President of the Hong Kong New Emerging Technology Education Association, Honorable Advisor of Seed Master Youth Development Foundation and holds several other notable positions.

Through his leadership and expertise, Emil has played a vital role in shaping the future of finance and technology in Hong Kong and the Greater Bay Area. His tireless efforts to build a strong and nurturing ecosystem for the next generation of innovators and entrepreneurs have earned him widespread respect and admiration.

Dr. Raymond Chan

Dr. Raymond Chan is now the Vice President of a global crypto exchange with a “deemed” licence by the SFC. He was the ex-CEO and director of Metaverse Securities, an online securities broker, and iFund, an online fund platform, both subsidiaries of 9F Inc., a NASDAQ-listed Chinese fintech group. He acted as the OMO/RO holding Type 1,2,4,5,9 SFC license with virtual assets uplifted. He was also the former MD of 9F Inc. since 2018.

He is currently the proposed Responsible Officer for the VATP “deemed” licenses. Before that, he successfully uplifted Metaverse Securities' type 1 and 4 licenses for VA dealing and advisory. He was also the designated CEO to apply for virtual bank license in Hong Kong and EMI license Lithuania for 9F Group. Raymond was selected “Leader of the Year” by IFTA.

Raymond is well-known as the founder of the first virtual banking, inMotion of CITIC Bank International, launched in Hong Kong before any virtual bank licenses were issued. In 2017, he led CITIC Bank to successfully obtain HKMA’s approval of eKYC and changes of related laws to make it possible. He worked in the banking industry for more than 20 years, holding management positions including GM of China CITIC Bank International and Head of Marketing of ICBC (Asia). His career covers all areas of banking, including head of e-business, Marketing, Branch Network, Call Centre, Sales and distribution, operations, and technical services from HSBC, Standard Chartered, ICBC, and CITIC.

Raymond is the author of the best-sellers “New Finance Revelation” and “New Finance Revelation 2.0”. He is also a columnist for various media, including Ming Pao, Oriental Daily, iMoney, and Orange News.

Besides being a seasoned practitioner in banking and fintech areas, including Web3, virtual asset, virtual bank, eKYC, and mobile payment, Raymond also actively serves in the community:

• Founding Chairman, Greater Bay Area Fintech League

• Vice Chairman, Institute of Financial Technologists of Asia

• Vice Chair, Hong Kong Digital Finance Association

• Vice Chairman, Greater China Financial Professionals Association

• Vice Chairman, Accounting Committee, Chinese Academy of Governance (HK) Industrial and Commercial Professionals Alumni Association

• Honorary Advisor, General Union of Hong Kong Accounting Professionals and Staff

• Director and Chief Fintech Advisor, Society of Registered Financial Planners

• Career Development Committee and Advisory Board of MIBF, Lingnan University

• Part-time Lecturer, HKUST, HKU Business School, and HKU SPACE

• Professional Consultant, GBA Business School

• Chief Judge, Hong Kong ICT Awards – Fintech Award

• Entrepreneurship Committee Advisory Group, Hong Kong Cyberport

Raymond received a Doctor of Business Administration and a Master of Applied Business Research from SBS Swiss Business School, an MBA from the Chinese University of Hong Kong, and a BSc (Engineering) from the University of Hong Kong. In 2019 and 2020, he studied China Studies Programmes at Tsinghua University and completed with a Certificate of Honour. In 2021, he completed the “2021 Global Financial Leaders Training Course” of Fudan University. He is a Fellow in HKSI, HKCS, HKRFP, and has professional designations including HKRFP, CFT (Certified Financial Technologist), CFT (China Banking Association), Shenzhen-Hong Kong-Macau Fintech Professional, Chartered Global FinTech, CESGS, CMA(Aust.), MIPA, and AFA.

Ms. Rowena Lai

Ms. Rowena Lai has extensive experience in business and data analytics in different business sectors. She is currently working in a well-known international bank and leading various data analytics projects. She graduated from the Chinese University of Hong Kong with a Bachelor of Science degree (major in Mathematics and Minor in Economics), and obtained a Master of Science in International Shipping and Transport Logistics as well as a Master of Science degree in Global Supply Chain Management from the Hong Kong Polytechnic University. Ms. Lai is currently a Certified Analytics Professional (CAP) from INFORMS. With her practical experience in data analytics and professional knowledge in financial technology, she teaches "Big Data and FinTech" module under Postgraduate Diploma in Investment Management and Financial Intelligence, Executive Certificate in Big Data and Data Analytics as well as Executive Certificate in Text Analytics and NLP with Financial Technology.

Guest Speaker

Dr. Dorothy C.K. Chau

Dr. Chau was a Senior Lecturer and Programme Director at the HK Baptist University, within the School of Business. Dr. Chau was the Director of the new Master in Finance (FinTech and Financial Analytics), bringing together the best minds and leaders in Finance, FinTech, A.I., RegTech, Privacy and Cybersecurity. With over 8 years in this space, Dr. Chau is a seasoned FinTech professional with a strong reputation as being an industry and academic liaison. Dr. Chau’s deep industry connections has allowed her to bring the biggest and best organizations from Tencent, Alipay, IBM, UBS, BNP Paribas, Ant Financial, Deloitte, Ping An Bank, Crypto.com and others to work with her to integrate content into her programmes, where she has successfully built industry-academic collaboration. She is also the advisor and chairman of the Data Privacy Special Interest Group of the Institute of Financial Technologists of Asia (IFTA) and the founding council member and chairman of the blockchain education committee of the Hong Kong Blockchain Development Association (HKBCDA).

Dr. Chau is also the Co-Chair of the International Association of Privacy Professionals (IAPP), and inducted as a Fellow of Information Privacy (FIP). In addition to her CIPP/A and CIPM certifications, her Certified Information Privacy Professional / Europe (CIPP/E) certification makes her a sought out expert on the topic of General Data Protection Regulation (GDPR), where she has presented to audiences both locally in Hong Kong and China, including CPA Australia, The Hong Kong Institute of Certified Public Accountants, The Hong Kong Independent Non-executive Director Association, HKUSPACE, The Association of Chartered Certified Accountants, The Hong Kong Institute of Directors, and more.

Mr. Henrique Centieiro

Henrique is a Best Seller author with 2 blockchain books and 6 years of experience with blockchain and cryptocurrencies.

Henri is working as Innovation Project Manager for HSBC Hong Kong implementing Blockchain and Innovation Projects and he has been teaching blockchain for 4 years. With 15 years of experience in the financial industry and extensive experience managing Blockchain and Fintech projects, in the last few years, he has implemented multiple Fintech related projects leveraging public and private blockchains such as Ethereum, Hyperledger Fabric and Corda to bring business value to corporate customers and financial industry.

Henrique is also a Scrum Master and a Certified Blockchain Architected, Blockchain Developer, AWS Certified Architect, Developer and Sysops Admin, and Certified Corda Blockchain Developer. He has been teaching Blockchain and Fintech for the last 4 years and is also a frequent speaker in Blockchain, Fintech and Supply Chain conferences.

Ms. Frankie Tam

Frankie is qualified in Hong Kong, New York, and England & Wales. Her practice covers a wide array of commercial and tech-related matters, including Fintech, Regtech, blockchain and virtual assets services agreements and data privacy matters.

Frankie is a member of the Vetting Committee of Hong Kong Innovation and Technology Commission’s General Support Programme and Enterprise Support Scheme, where she advises the Government on merits of technology projects. Frankie has mentored distributed ledger technology companies at Accelerator programmes, and contributed to CBDC research projects with leading blockchain companies. She is on the advisory board of the Stanford University’s Responsible Digital Leadership project. Frankie is the Convenor of AML Regtech Committee of Institute of Compliance Officer of Hong Kong. She teaches Regtech and Fintech programmes at postgraduate degrees, and has extensive experience sharing at professional bodies’ CPD programmes and industry conferences.

Mr. Edmond Lau

Mr. Lau has 20 years of profound experience in investment, financing and business development, and is currently the Managing Director of Lingfeng Capital focusing on Fintech investment. He was the Head of Innovative Incubation Centre and the Head of Merger & Integration in SF-Express responsible for establishment, due diligence and management of incumbents and investments. Prior to that, he served as the Head of Investment in FIH Mobile and the Investment Director in CLSA Capital Partners focusing on areas like mobile Internet, mobile application and water technologies. Edmond was previously a Vice President in Citigroup and a senior consultant in Accenture providing financing solutions and strategic advices to telecom, media and technology corporations.

Mr. Lau holds an MBA (distinction) from London Business School, a Bachelor of Information Engineering (first class) from Chinese University of Hong Kong, and a Bachelor of Laws from China University of Political Science and Law. He is the founding board member of CFA Shenzhen Association, Co-President of Hong Kong Internet Finance Association, and a former board member of Hong Kong Society of Financial Analysts. He is also a CFA and a FRM.

Programme Details

| Application Code | 2380-EP133A | Apply Online Now |

| Apply Online Now | ||

Days / Time

- Tue, Fri, 7:00pm - 10:00pm

- 30 hours per module

- Hong Kong Island Campus

- Kowloon East Campus

- Kowloon West Campus

Modules & Class Details

Modules

Course Content :

|

(1) Introduction to Blockchain Technology and Applications

(2) Blockchain and related FinTech applications

(3) Regulatory and Legal issues around Blockchain

|

Assessment method: two take-home exercises + individual assignment

The Executive Certificate will be conferred to candidates who pass in continuous assessment and final assessment as well as achieved at least 70% attendance of the programme.

Class Details

Timetable

| Lecture | Date | Time |

| 1 | 14 Apr 26 (Tue) | 19:00-22:00 |

| 2 | 17 Apr 26 (Fri) | 19:00-22:00 |

| 3 | 21 Apr 26 (Tue) | 19:00-22:00 |

| 4 | 24 Apr 26 (Fri) | 19:00-22:00 |

| 5 | 28 Apr 26 (Tue) | 19:00-22:00 |

| 6 | 5 May 26 (Tue) | 19:00-22:00 |

| 7 | 8 May 26 (Fri) | 19:00-22:00 |

| 8 | 19 May 26 (Tue) | 19:00-22:00 |

| 9 | 22 May 26 (Fri) | 19:00-22:00 |

| 10 | 26 May 26 (Tue) | 19:00-22:00 |

Remarks:

- Tentative timetable is subject to change, and course commencement is subject to sufficient enrollment numbers.

- To ensure that student’s academic progress is not affected, the School may substitute face-to-face classes with online teaching if face-to-face classes cannot be held.

Fee & Entry Requirements

Fee

HK$150 (Non-refundable)

Course Fee- Course Fee: $9500 per programme (* course fees are subject to change without prior notice)

Entry Requirements

Applicants shall hold:

a) a bachelor’s degree awarded by a recognized University or equivalent; or

b) an Associate Degree/ a Higher Diploma or equivalent, and have at least 2 years of relevant working experience.

Applicants with other qualification and substantial senior level work experience will be considered on individual merit.

**Please upload copy of HKID and proof of degree while applying online.

Apply

Online Application Apply Now

Application Form Download Application Form

Enrolment MethodOnline Enrolment

HKU SPACE provides 24-hour online application and payment service for students to apply to selected award-bearing programmes and to enrol in most open admission courses (courses enrolled on a first come, first served basis) via the Internet. Applicants may settle the payment by using either "PPS by Internet" (not available via mobile phones), VISA or Mastercard online. Online WeChat Pay, Online AliPay and Faster Payment System (FPS) are also available for continuing enrolment in the same programme, if online service is offered.

For first time enrolment

-

Complete the online application form

Applicant may click the icon

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

on the top right-hand corner of the programme/course webpage to make online application, and then follow the instructions to fill in the online application form.

Some programmes/courses may admit by selection, and may require applicants to provide electronic copy of any required documents (e.g. proof of qualification) as indicated on the programme/course webpage. Only file format in doc, docx, jpg and pdf are supported. -

Make Online Payment

Pay the application or programme/course fees by either using:

"PPS by Internet" - You will need a PPS account and a PPS Internet password. For information on how to open a PPS account and how to set up a PPS Internet password, please visit http://www.ppshk.com.

*Credit Card Online Payment - Course fees can be paid by VISA or Mastercard including the “HKU SPACE Mastercard”.

* HKU SPACE Mastercard cardholders who wish to enjoy 10-month interest free instalment scheme must pay their tuition fees in person at any of our HKU SPACE Enrolment Centres.

To know more about first-time online application/enrolment and payment, please refer to the user guide of Online Application / Enrolment and Payment:

For continuing enrolment in the same programme

Selected programmes offer online continuing enrolment service. Programme staff will inform students if they offer this service and offer further enrolment details.

Online Payment can be made via "PPS by Internet" (not available via mobile phones), VISA or Mastercard, Online WeChat Pay, Online AliPay and Faster Payment System (FPS)

In Person / Mail

For first time enrolment

-

For first come, first served short courses, complete the Application for Enrolment Form SF26 and bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

[Download Enrolment Form SF26] -

Award-bearing and professional courses may require other information. Forms are usually available at the enrolment centres or on request from programme staff. Bring or post the completed form(s), together with the appropriate application/course fee(s) and any required supporting documents to any of the HKU SPACE enrolment centres.

For continuing enrolment in the same programme

-

The standard ‘Enrolment/Payment Slip’ is designed for students of award-bearing programmes or remaining programmes in a suite of programmes requiring continuing enrolment and it applies to most programmes.

-

Students should complete the “Enrolment/Payment Slip” which will be made available by relevant programme staff and return the slip to any HKU SPACE enrolment centre or post it to the relevant programme staff with appropriate fee payment.

Please refer to available Payment Methods for fee payment information. If you are in doubt about the procedures, please check the individual course details, or contact our programme staff or enrolment centres.

Please note the followings for programme/course enrollment:

- To make an application online, you will need a computer with connection to the Internet and a web browser with JavaScript enabled. Google Chrome is recommended.

- Applicants should not leave the online application idle for more than 10 minutes. Otherwise, applicants must restart the application process.

- Only Early Bird Discount is supported for Online Applicants (Application). To enjoy other types of discount, please visit one of our enrolment centres.

- During the online application process, asynchronous application and payment submission may occur. Successful payment may not guarantee successful application. In case of unsuccessful submission, our programme staff will contact you shortly.

- Applicants are reminded that they should only apply for the same programme/course once through counter or online application.

- For online enrolment, a payment confirmation page would be displayed after payment has been made successfully. In addition, a confirmation email would also be sent to your email account. You are advised to keep your payment confirmation for future enquiries.

- Fees paid are not refundable except as statutorily provided or under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment).

- If admission is by selection, the official receipt is not a guarantee that your application has been accepted. We will inform you of the result as soon as possible after the closing date for application. Unsuccessful applicants will be given a refund of programme/course fee if already paid.

Disclaimer

The School provides a platform for online services for a selected range of products it offers. While every effort is made to ensure timeliness and accuracy of information contained in this website, such information and materials are provided "as is" without express or implied warranty of any kind. In particular, no warranty or assurance regarding non-infringement, security, accuracy, fitness for a purpose or freedom from computer viruses is given in connection with such information and materials.

The School (and its respective employees and subsidiaries) is not liable for any loss or damage in connection with any online payments made by you by reason of (i) any failure, delay, interruption, suspension or restriction of the transmission of any information or message from any payment gateways of the relevant banks and/or third party merchants for processing credit/debit/smart card or other payment facilitation mechanism; (ii) any negligence, mistake, error in or omission from any information or message transmitted from the said payment gateways; (iii) any breakdown, malfunction or failure of those gateways in effecting online payment service or (iv) anything arisen out of or in connection with the said payment gateways, including but not limited to unauthorised access to or alternation of the transmission of data or any unlawful act not permitted by the law.

1. Cash, EPS, WeChat Pay Or Alipay

Course fees can be paid by cash, EPS, WeChat Pay or Alipay at any HKU SPACE Enrolment Centres.

2. Cheque Or Bank draft

Course fees can also be paid by crossed cheque or bank draft made payable to “HKU SPACE”. Please specify the programme title(s) for application and applicant’s name. You may either:

- bring the completed form(s), together with the appropriate course or application fees in the form of a cheque, and any required supporting documents to any of the HKU SPACE enrolment centres;

- or mail the above documents to any of the HKU SPACE Enrolment Centres, specifying “Course Application” on the envelope. HKU SPACE will not be responsible for any loss of personal information and payment sent by mail.

3. VISA/Mastercard

Applicants may also pay the course fee by VISA or Mastercard, including the “HKU SPACE Mastercard”, at any HKU SPACE enrolment centres. Holders of the HKU SPACE Mastercard can enjoy a 10-month interest-free instalment period for courses with a tuition fee worth a minimum of HK$2,000; however, the course applicant must also be the cardholder himself/herself. For enquiries, please contact our staff at any enrolment centres.

4. Online Payment

Online application / enrolment is offered for most open admission courses (enrolled on first come, first served basis) and selected award-bearing programmes. Application fees and course fees of these programmes/courses can be settled by using "PPS by Internet" (not available via mobile phones), VISA or Mastercard. In addition to the aforesaid online payment channels, new and continuing students of award-bearing programmes with available online service, they may also pay their course fees by Online WeChat Pay, Online Alipay or Faster Payment System (FPS). Please refer to Enrolment Methods - Online Enrolment for details.

Notes

-

If the programme/course is starting within five working days, application by post is not recommended to avoid any delays. Applicants are advised to enrol in person at HKU SPACE Enrolment Centres and avoid making cheque payment under this circumstance.

-

Fees paid are not refundable except under very exceptional circumstances (e.g. course cancellation due to insufficient enrolment), subject to the School’s discretion. In exceptional cases where a refund is approved, fees paid by cash, EPS, WeChat Pay, Alipay, cheque, FPS or PPS by Internet will be reimbursed by a cheque, and fees paid by credit card will be reimbursed to the credit card account used for payment.

- In addition to the published fees, there may be additional costs associated with individual programmes. Please refer to the relevant course brochures or direct any enquiries to the relevant programme team for details.

- Fees and places on courses cannot be transferrable from one applicant to another. Once accepted onto a course, the student may not change to another course without approval from HKU SPACE. A processing fee of HK$120 will be levied on each approved transfer.

- HKU SPACE will not be responsible for any loss of payment, receipt, or personal information sent by mail.

- For payment certification, please submit a completed form, a sufficiently stamped and self-addressed envelope, and a crossed cheque for HK$30 per copy made payable to “HKU SPACE” to any of our enrolment centres.